VIETNAM AUTOMOBILE INDUSTRY: Vehicles Made in Vietnam-European standards?

We can see that in Vietnam, most of the European and American car brands are absent, except for imported luxury cars such as BMW, MercedesBenz, Audi, Jaguar Land Rover, Volvo and Peugot which are imported by Truong. Hai Motor assembly last time.

Are European and American cars not good? Or European cars, American cars are not popular with Vietnamese people?

We discussed this concern with some experts and European Trade Counselors in Vietnam. According to them, European car brands, whether manufactured directly or through a third country, all comply with global quality standards and have very high homogeneity, there is no such thing as "low quality" that cannot be imported into Vietnam. Male.

So, why are European cars absent in Vietnam?

That is taxes and fees - the main barrier that makes it difficult for cars manufactured directly from Europe or from a third country to enter Vietnam. EU vehicles entering Vietnam are subject to import tax of over 50% depending on volume.

Another big factor next, EU imported car models all have a cylinder capacity of over 2,000cc, so they are subject to a very high excise tax rate from 50% to 90%. This greatly affects price competition and accessibility (purchasing power) of Vietnamese consumers.

Automotive expert Nguyen Minh Dong said that to make European car prices cheaper in Vietnam, Vietnam needs to open the door to electric cars. The current excise tax rate for electric vehicles is 15% for all types of vehicles regardless.

In 2030, European countries plan to eliminate internal combustion engines, only then will imported car models to Vietnam lower their prices (if Vietnam does not change the current tax rate) and Vietnamese customers can hope use European cars. However, it is still a long way from now and Vietnamese consumers will need to keep the European car dream for at least 10 more years.

The commercial counselor of a European country in Vietnam, who has experience in calling for investment from major car manufacturers, said that, in addition to taxes and fees, Vietnam lacks a real strategy to support the Vietnamese auto industry.

The automobile industry needs the involvement of many different industries and fields to develop synchronously (a car has nearly 30,000 components) from basic industry (materials, raw materials), to industrial auxiliary (all levels from mechanical to electronic, intelligent ...) and human (technical team with certain skills).

Many experts point out the risk of a shortage of skilled technicians in the auto industry if the growth explodes in the future because the domestic workforce is simply benefiting very little (value added). low rise) in the production line, delivering each car.

Based on the fact from a few lucky companies that have the opportunity to join famous car manufacturers in Vietnam, they and their workers are working as "laborers", helping to lay golden eggs for car manufacturers and manufacturers. Countries are the biggest beneficiaries of the current situation.

Many European investors also do not see a legal corridor for a series of other related issues such as: Tax policy on imported raw materials and components, import and export incentives in ASEAN, training policy and human resource development, development priorities and technology transfer support for Vietnam itself, investment environment preparation etc.

And a big priority issue is environmental policy. European investors and manufacturers will be under pressure on the environment. Mr. Bruno Hromy, Slovak commercial counselor said: “The idea of manufacturing based on the advantage of labor in Vietnam and exporting back to Europe will be less feasible because if you add environmental fees, the cost of components and products. The final product will be higher than on-site production. It is also a distinctive feature of the auto industry, which often forms continuous production chains within a certain dealer radius."

CHICKEN - EGG ISSUE

Quality standards and maintenance and warranty of European cars are highly appreciated and are posing the problem of "Chicken - Egg" with Vietnam's policy corridor.

Vietnamese consumers do not use many European cars, so car manufacturers do not have a "must" need to build and operate a system of dealers and customer centers for warranty and customer care. Since then, they have no chance to demonstrate and access service, quality of customer care and have no need to sell or invest in Vietnam because there is no market opportunity.

And the circle goes back to the first point, European car manufacturers do not see the large and attractive potential of the Vietnamese market and do not "vote" for Vietnam when compared to other Southeast Asian countries. .

Not to mention the fact that Vietnam's market size is too small compared to other countries in the region. The localization rate of cars in Vietnam is very low, only 7-10%, much lower than the set targets and far from the average localization figure of 55-60% of ASEAN.

Vehicles manufactured in Vietnam are mainly assembled with available imported components. When importing components at the same price as the country of manufacture, the costs of transportation, storage, etc. also push up the production cost of the car, higher than the price of imported CBU.

MONEY CAN'T BUY CAR

Because familiar European car manufacturers do not have an "official" presence in Vietnam, there are many "tears or laughs", especially for professional diplomats.

The deputy ambassador of a European embassy in Hanoi told about his insurmountable difficulty.

The Embassy wants to have a Made In Europe car as a pride like "Europeans use European goods" in Vietnam. After working with all the famous car manufacturers involved, he received "polite" rejections.

Those companies cannot sell cars to the embassy because there are no service centers in Vietnam. The embassy also does not dare to waste money and time if each time the car needs to be re-exported to neighboring countries in Vietnam (usually China or India) for warranty or repair, and then re-imported. Vietnam use.

After a period of "fighting", the European embassy had to buy a Japanese car officially distributed in Vietnam.

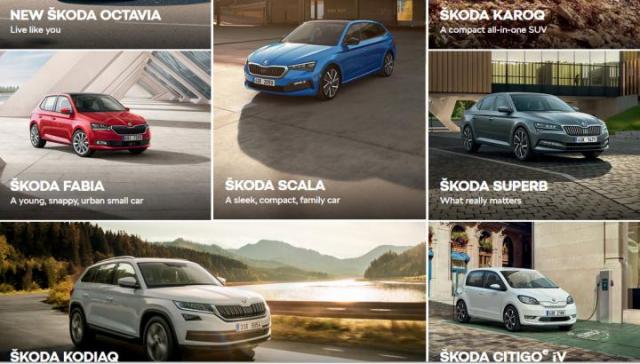

The Czech Embassy in Vietnam was very brave when it decided to use a famous Czech brand Skoda car for its operation in Vietnam. "May the car not need maintenance or encounter any problems on the streets of Vietnam, because then they/we won't know what to do?", the diplomats once jokingly joked with each other. So, if anything happens, the Czech Embassy will have more work to do: re-export to China or India for warranty or repair, then re-import to Vietnam !

NOT SATISFIED

During the working process, an unexpected fact occurred, Czech and Slovak auto parts manufacturers were not interested in coming to Vietnam.

This is surprising because many in the group think that Vietnam is an attractive and worthwhile market after the Vietnam-European free trade agreement came into effect along with the free trade agreement that transformed the bloc. Asean becomes a huge market with a population larger than the EU combined.

For many reasons, there are thoughtful concerns of Czech and Slovak auto parts manufacturers.

The market is too small

According to the announcement of the Southeast Asian Automobile Association (AAF), total car sales in the region include Brunei, Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam reached 2,453,808 units in 2020, down 29% compared to 2019 due to the impact of the COVID-19 epidemic.

Thailand still leads Southeast Asia in 2020 despite a 29% decrease, with 1,427,074 units shipped. This figure helps Thailand keep the ratio between car productions nearly twice as high as domestic car sales. Sales of 792,146 vehicles sold during the year.

Indonesia sold 532,027 vehicles, ranked second, down 48%. The third place belongs to Malaysia with sales of 522,573 vehicles sold in 2020.

Vietnam ranked fourth with sales of 400,000 vehicles, with nearly 395,000 vehicles manufactured and assembled in the country.

Thus, according to the market size, manufacturers will not choose Vietnam. The small market will not guarantee the investment scale, not be convincing enough and always have the potential risk of output not meeting financial indicators. According to industry experts, currently only Thailand is the only country in the region that meets the criteria for production scale.

However, there are positive signs. The National Assembly of Vietnam is discussing the possibility of reducing excise tax (corresponding to the localization rate of each car model) to stimulate people's demand. But in the current context of being affected by the Covid pandemic, according to SSI Research, the possibility of reducing excise tax for cars is very low because this amount alone contributes to 4.4% of Vietnam's budget revenue.

There is no clear investment support policy yet

One of the major obstacles makes European auto parts manufacturers not interested in coming to Vietnam because they have not seen the clear and calculated incentives of the policy corridor.

A representative of a European car company who has been to Vietnam to survey the market said: "We came here with a lot of questions that needed answers, but we couldn't find the answers and it seems like there will be no answers in the near future.”

He also acknowledged: “We have a lot of respect for Japanese and Korean companies. They have come to invest very successfully in Vietnam. But there are a lot of things we can't and won't do because of our business style and culture."

The EU-Vietnam Free Trade Agreement has come into effect, but tariff barriers for the auto industry are still opening too slowly. In addition, the necessary incentives for raw materials, equipment and technology have not been set properly. After 7 to 10 years for the import tax on cars from Europe to be close to zero, it will be too slow for a growing auto industry like today.

A member of the Slovak Automobile Manufacturers Association said: “We have many other places that invite and welcome with more attractive offers.”

Workforce problem

The next future problem European manufacturers worry about is people. Because of the characteristics of the auto industry, it always creates a supply chain that links within a reasonable radius, so there will be a high concentration of component manufacturers. This requires a large technically skilled workforce. "I didn't see any vocational schools, technical colleges or the like in many of the regions we visited," said one European auto industry expert. Although Vietnamese people are famous for their diligence and hard work, that is only a necessary condition, not all.

Advantage

However, Czech and Slovak auto parts manufacturers also see positive opportunities in Vietnam. The rapidly increasing domestic vehicle production output is gradually meeting the needs of consumers, such as Mitsubishi will open a second factory in Vietnam, a major European car company is planning and contacting to invest in Vietnam. Vietnam is bringing positive signals to help lower car prices, creating more opportunities for Vietnamese consumers.

Finally, taxes and fees will gradually reduce fees for cars thanks to the influence of Decree 57/2020/ND-CP and the EVFTA and ATIGA Agreements taking effect step by step. This impact will affect and facilitate cheaper car prices.

Vietnam is also the second country (after Singapore) to have a free trade agreement with the European Union and this is a big advantage for investors. Combined with ASEAN's common free trade agreement, investors through Vietnam can directly access their products manufactured with a certain localization rate of the entire ASEAN trade market.

Le Thanh Nam

VEHICLES MANUFACTURED IN VIETNAM IS MAJOR ASSEMBLY OF AVAILABLE IMPORTED COMPONENTS. WHEN IMPORTING COMPONENTS AT THE QUALITY PRICE WITH MANUFACTURING COUNTRIES, TRANSPORTATION, STORAGE COSTS,... ALSO PURCHASE THE PRODUCTION PRICE OF VEHICLES UP, HIGHLY HIGH THE PRICE OF IMPORTED CAR COMPLETE. HOWEVER, LUXURY VEHICLES ASSEMBLY IN VIETNAM ARE CHEAPER than IMPORTED VEHICLES BECAUSE MOST OF THESE MODELS ARE IMPORTED FROM OUTSIDE ASEAN. THAT IS THE INTERESTING paradox of VIETNAM'S VEHICLE INDUSTRY.

FOLLOWING DATA OF THE GENERAL DEPARTMENT OF CUSTOMS, IN 3 YEARS

BACK HERE, THE NUMBER OF VEHICLES IMPORTED FROM 3 ENGLISH, GERMANY, FRANCE TO VIETNAM ALWAYS REDUCES AND ONLY BELOW 5% OF THE TOTAL VEHICLE IMPORTED. IN 2020, ONLY 1,300 CARS (1.23%) WERE IMPORTed (OUT of 105,000 VEHICLES IMPORTED INTO VIETNAM) FROM THIS 3 COUNTRIES, 700 REDUCED COMES compared to 2019.

- Slovak newlyweds conquer Latin America in the ‘ugliest car in the world’

- Priest’s 1880 book leads to discovery of forgotten settlement and trade route

- New highway sticker prices set to rise

- What will the proposed transaction tax mean for you?

- Fico finally takes steps to consolidate: late and flawed, but it could have been worse

- Top 10 events in Bratislava for foreigners

- 3 things to do in Bratislava for free in the next seven days

- News digest: Border village left stranded as Danube rises

- Oldest canoe club in Bratislava celebrates centenary, then battles floods

- Culture minister blames former National Gallery director once again, this time for water leaks

- Minister Kamenický’s planned book VAT hike faces fierce backlash from all sides

- Slovak Matters: in praise of burčiak

- Weighing more than 5,000 elephants, this bridge is paratroopers and filmmakers’ favourite

- News digest: Buy books? Minister says you’re wealthy and should pay more for them

- News digest: Read books? Minister says you’re wealthy and should pay more for them

- Opposition leader Šimečka removed as deputy speaker, but remains unshaken

- “It’s a must”: How PM Fico plans to fix Slovakia’s public finances

- Slovak-Belgian team unearths extinct lizard in Europe—a species once known only from the US