VIETNAM AUTOMOBILE INDUSTRY: Supply & Demand Paradox

According to the forecast, if nothing changes, from 2025, the entire private car market in Vietnam will account for the main import proportion. That's because cars made in Vietnam are more expensive than imported CBU cars.

The paradox that imported cars are cheaper than domestically produced cars has "stimulated the curiosity" of investors from Europe.

Last year, in Hanoi, the first meeting at the Slovakia-Vietnam Chamber of Commerce of action group “Auto EU”, with the participation of trade counselors of Czech Republic, Slovakia, secretary of Vietnam Automobile Manufacturers Association (VAMA), Vietnam Accessories Industry Association Nam, representative of Vinfast… The purpose of the group is to prepare for the program to bring Czech and Slovak auto accessory manufacturing companies to Vietnam to explore and appraise investment opportunities under the original initiative. Slovakia-Vietnam Chamber ò Commercee.

Information given during the meeting - it is expected that Vietnam's car consumption from now to 2025 will be about 1 million 500 thousand car – confused the Czech embassy representative. Because that is a very small number compared to the annual production of cars produced in the Czech Republic. Only one big famous Czech car company produces that many cars in a year.

It is also one of the first biggest difficulties that has limited the interest of European auto accessories manufacturers in general, and of the Czech Republic, Slovakia (which are countries with a developed automobile industry at reasonable cost and investment) in particular when deciding to participate in the Vietnamese automobile market. The market is small, consumption is low, so the output is not enough to meet the requirements of balancing investment. Until now, except Mercedes luxury cars, in fact, no major European manufacturers have participated in the Vietnamese automobile market.

Specifically, to invest in an auto parts factory with a level of 12 million USD and a payback period of about 5 years (equal to an average life cycle of a car) will need an output of at least 60,000 products during the year. However, currently in Vietnam only Vios (of Toyota) and recently of Vinfast have achieved a production at 27,000 - 30,000 cars/year.

The reason why Vietnam's auto industry has these paradoxs existed for many years now is this: Limited raw materials. This is a detail that is rarely talked about but is very important in the manufacturing industry (especially making accessories for large factories) because of the strict requirements and specifics of the industry.

The second is limited human resources. Although Vietnam has advantages over ASEAN countries in terms of engineers and technicians with experience and direct knowledge from Europe, it lacks a skilled technical workforce according to the new requirements of foreign countries in leading industries (such as electronics, automobiles etc.).

Third, the supporting industry is not developed. That is the challenge for European auto parts manufacturers. According to a specialized report of a securities company belonging to one of the major commercial banks in Vietnam, currently, the level of completion of the value chain of the Vietnamese automobile industry is very low in the absence of even suppliers level 1 and lower levels.

As of 2019, Thailand has up to 710 tier 1 suppliers and 1,700 tier 2 suppliers, while Vietnam has only 33 tier 1 suppliers and 200 tier 2 suppliers. Meanwhile, in Thailand, the 1st-tier foreign suppliers account for 58% with big names such as Bosch, Magna, Denso, Toyota Soshoku, Toyota Gosei, etc. The participation of international suppliers and parts manufacturers has an influence and promotion. That is huge with the formation and development of domestic component manufacturers.

The fact that car manufacturers occupy the largest market share in Vietnam from Japan and South Korea often cooperate with their designated suppliers, which has greatly influenced the development and existence of Vietnam's supporting industry. .

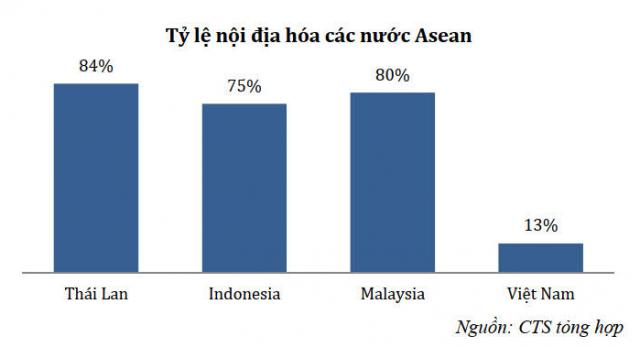

All will come back to affect production costs and prices for consumers in Vietnam. According to Toyota Vietnam, the low localization rate makes the production cost of the Vietnamese automobile industry 10% higher than that of other countries in the region. Toyota Vietnam has planned to import CBU cars from ASEAN countries instead of domestic assembly.

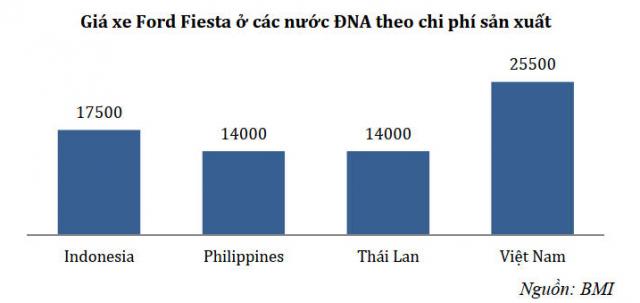

According to BMI's report, the production cost of Ford Fiesta in Vietnam is 20% higher than in other countries in the region for the same reason.

In the opinion of many experts, Vietnamese companies have invested a lot (too much) in basic production machinery items, now they are more than capable of producing many components for different industries, but they are still struggling lack of promotion strategy, coordination to find customers. In other words, machines are more than enough, but are lacking a clear output strategy, technology and financial foundation.

Many companies have invested in long-term production lines and are heavily dependent on orders from many Japanese and Korean companies. Products for Japanese and Korean companies account for 40%-60% or higher in the production structure.

This is a huge potential risk and affects many companies, especially during the Covid-19 epidemic, parent companies and supply chains are disrupted.

Fourth is foresight. The future of petrol/oil-injected cars won't last too long. In the next 10-15-20 years, current cars will be partially and mostly replaced by electric vehicles to ensure environmental and efficiency requirements. Currently, the cost of electric cars is still high and unsuitable because the output is small and production is concentrated in a number of car centers around the world. The big car companies are waiting for the governments of many countries to announce new traffic regulations; electric cars will quickly occupy the market share of traditional cars.

With the exception of Tesla, the big companies (except Toyota) have been researching electric cars and support systems for more than 10 years and just waiting for the right time to change the market structure. Up to now, nearly all major automakers have launched electric vehicle products with many different levels and models.

Most recently, Ford introduced an electric version of the famous pickup truck F-150 with outstanding reviews and features not inferior to the traditional F-150, which is considered a turning point of the century for original electric car in the US (valued more than the introduction of Tesla models).

Vietnam is on the way with the risk of becoming a dumping ground for production lines that will be obsolete in the next 10-15 years without appropriate policies and strategies. In addition, because there is no developed industry (such as European countries, Japan or Korea),

Vietnamese companies actually only assemble finished components or process only part, simple and does not create added value,. Meanwhile, if "jumping" skips the last stage of gasoline/oil-injected car technology, Vietnam will bypass the necessary barrier of the developed (main and auxiliary) industry and go straight to resources can be used: The biggest is people - a young workforce well versed in new technologies.

Not only taking advantage of the opportunity to participate in the production chain (electric cars and later generations) that is forming at the first stage, Vietnam also takes advantage of the great geographical advantage when there is the Agreement. free trade in ASEAN (650 million people) and located right next to the market with the largest population in the world - China. If used correctly, it is an ideal logistical advantage and entails advantages in terms of emissions quotas.

Currently, automobile assembly and manufacturing companies in Vietnam have a very low localization rate. Therefore, the advertisement calling for the use of "Vietnamese products" is not entirely accurate. That is also a huge opportunity for foreign component manufacturing companies to participate, invest and manufacture in Vietnam.

Hoàng Nhung

THE DEVELOPMENT AND USE OF ELECTRIC CAR IS REAL ENVIRONMENTAL MEANING ONLY IF THE POWER SUPPLY IS PRODUCED FROM RECYCLED SOURCES (Electricity CLEAN) WITH REASONABLE RATE.

CURRENTLY VIETNAM IS PRODUCING NEARLY 45% OF THERMAL ELECTRICAL ELECTRICAL ELECTRICITY, PRIORITY TO USE ELECTRIC MOTORCYCLES OR ELECTRIC CAR CANNOT MEET THE ENVIRONMENTAL CLEANING OBJECTIVE THAT HAS A ENVIRONMENTAL EFFECT. OR AS PEOPLE ARE JOKING: “Riding EVs (OR ELECTRIC CARs) causes more ENVIRONMENTAL POLLUTION than MOTHER USE COAL in the KITCHEN”.

INVESTED IN A US$12 MILLION AUTO COMPONENTS PRODUCTION FACTORY AND RETURN ON INVESTMENT approx 5 YEARS (Equal to an AVERAGE LIFE OF CAR) WILL NEED A YEAR OF LEAST 60,000 PRODUCTS. HOWEVER, CURRENTLY IN VIETNAM ONLY VIOS (TOYOTA'S) AND VINFAST'S RECENTLY ACHIEVE AT 27,000 - 30,000 VEHICLES/YEAR.

- News digest: Border village left stranded as Danube rises

- Oldest canoe club in Bratislava celebrates centenary, then battles floods

- Culture minister blames former National Gallery director once again, this time for water leaks

- Minister Kamenický’s planned book VAT hike faces fierce backlash from all sides

- Slovak Matters: in praise of burčiak

- Weighing more than 5,000 elephants, this bridge is paratroopers and filmmakers’ favourite

- News digest: Buy books? Minister says you’re wealthy and should pay more for them

- News digest: Read books? Minister says you’re wealthy and should pay more for them

- Opposition leader Šimečka removed as deputy speaker, but remains unshaken

- “It’s a must”: How PM Fico plans to fix Slovakia’s public finances

- Slovak-Belgian team unearths extinct lizard in Europe—a species once known only from the US

- Bratislava floods stabilise as military shuttles deployed in Devín

- Bobaľky, pirohy, holubky: find these traditional Slovak dishes in this Slovak-American's cookbook

- News digest: While some sandbag, others watch and pray—guess which group the president joined?

- A political bomb that didn’t explode

- Archaeologists in Trenčín on the hunt for a secret room

- The Danube peaks Tuesday; Devín borough isolated by flooding

- Last Week: Attempt to oust Šimečka exposes coalition’s hypocrisy